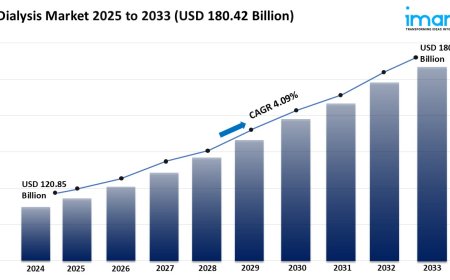

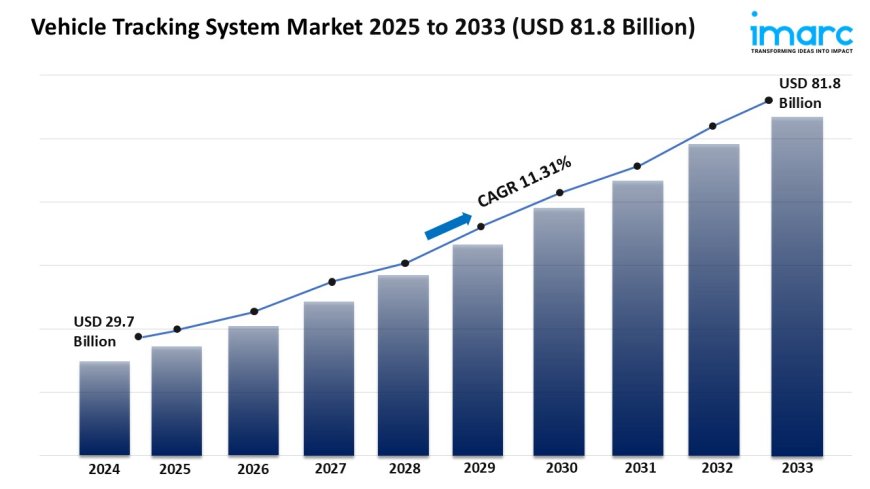

Vehicle Tracking System Market Size, Growth, and Forecast 2025-2033

The global vehicle tracking system market size reached USD 29.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 81.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.31% during 2025-2033.

Market Overview:

The vehicle tracking system market is experiencing rapid growth, driven by rising demand for fleet management efficiency, growing focus on vehicle safety and security, and expansion of IoT and cloud-based solutions. According to IMARC Groups latest research publication, Vehicle Tracking System Market Report by Component (Hardware, Software), Type (Active, Passive), Vehicle Type (Commercial Vehicles, Passenger Vehicles), Application (Mobile Tracking, Cellular Tracking, Satellite Tracking), Industry Vertical (Transportation and Logistics, Construction and Manufacturing, Aviation, Retail, Government, and Others), and Region 2025-2033, the global vehicle tracking system market size reached USD 29.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 81.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.31% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/vehicle-tracking-system-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Vehicle Tracking System Market

- Rising Demand for Fleet Management Efficiency

Businesses are leaning hard into vehicle tracking systems to streamline fleet operations and cut costs. With logistics and transportation companies handling massive delivery volumes, real-time tracking helps optimize routes, reduce fuel consumption, and improve driver accountability. For example, a report from The Business Research Company highlights that the surge in e-commerce and last-mile delivery is pushing companies to adopt GPS-based solutions for better visibility. In the U.S., trucks move over 70% of freight by weight, making fleet efficiency critical. Companies like Amazon and UPS rely on these systems to monitor thousands of vehicles, ensuring timely deliveries while minimizing downtime. Government mandates, like those requiring tracking for commercial fleets in Europe, further fuel adoption, as firms aim to meet compliance and boost operational performance.

- Growing Focus on Vehicle Safety and Security

Safety concerns are driving vehicle tracking system adoption as theft and unauthorized use rise. Advanced GPS trackers with anti-theft features, like geofencing and real-time alerts, are becoming must-haves for both commercial and personal vehicles. A study by Transparency Market Research notes that increasing vehicle theft rates globally are pushing demand for tracking solutions. For instance, in urban areas like India and Brazil, where vehicle theft is a growing issue, consumers and businesses are investing in trackers for peace of mind. Companies like Trackimo and Verizon are rolling out innovative devices with AI-powered intrusion detection, enhancing security. Government initiatives, such as mandatory tracking for school buses in some regions, also play a big role, ensuring safety while encouraging market growth through regulatory support.

- Expansion of IoT and Cloud-Based Solutions

The integration of IoT and cloud technology is supercharging the vehicle tracking industry. These systems allow real-time data sharing, predictive maintenance, and seamless connectivity across platforms. For example, DataM Intelligence reports that IoT-enabled trackers are transforming logistics by offering insights into vehicle health and driver behavior. Companies like Geotab and Calamp are launching cloud-based platforms that let fleet managers monitor thousands of vehicles from a single dashboard. This tech is a game-changer for industries like construction and oil & gas, where remote asset tracking is critical. Government-backed smart city projects, especially in Asia-Pacific countries like China and India, are also boosting demand by embedding IoT tracking in public and commercial fleets, making operations smarter and more efficient.

Key Trends in the Vehicle Tracking System Market

- Adoption of AI-Powered Analytics

AI is shaking up the vehicle tracking world by turning raw data into actionable insights. Systems now analyze driver behavior, predict maintenance needs, and optimize routes using machine learning. For example, Transoft Solutions acquisition of Advanced Mobility Analytics Group in 2024 boosted its AI capabilities for road safety, showing how companies are investing in smart tech. These systems can flag risky driving patterns or predict engine issues, saving fleets millions in repair costs. In logistics, AI cameras on expressways can detect accident risks and dispatch patrols in under two minutes. This trend is especially big in smart cities like those in China, where AI-driven tracking is integrated into traffic management, making roads safer and operations smoother for everyone involved.

- Growth of Personal and Asset Tracking

Vehicle tracking isnt just for fleets anymorepersonal and asset tracking is booming. Consumers are using GPS devices for cars, pets, and even personal safety, driven by concerns over theft and emergencies. Valuates Reports notes that demand for personal trackers is surging in urban areas, with devices offering features like geofencing and speed alerts. For example, parents use trackers to monitor teen drivers, while companies like Letstrack provide solutions for personal vehicles and employee safety. In retail, asset trackers protect high-value goods during transport. Government mandates, like those for tracking school buses in India, are also pushing this trend, blending personal safety with regulatory needs. This shift is making tracking systems a household staple, not just a business tool.

- Integration with Smart City Infrastructure

Smart city projects are weaving vehicle tracking into urban ecosystems, especially in fast-growing regions like Asia-Pacific. Cities like Singapore and Shanghai are using GPS systems to manage traffic, reduce congestion, and support autonomous vehicles. DataM Intelligence highlights that government investments in intelligent transportation systems are driving tracker adoption. For instance, smart-signal grids in major cities adjust lane priorities based on 30-second vehicle counts, easing traffic flow. Companies like Teltonika are supplying trackers for public transit and logistics, integrating them with city-wide IoT networks. This trend is transforming how cities operate, with vehicle tracking systems playing a key role in real-time traffic management and sustainable urban planning, making cities more efficient and livable.

Leading Companies Operating in the Global Vehicle Tracking System Industry:

- AT&T Inc.

- Cartrack

- Continental AG

- Geotab Inc.

- Inseego Corp.

- Orbcomm

- Robert Bosch GmbH

- Spireon Inc.

- Teletrac Navman (Vontier Corporation)

- TomTom N.V.

- Verizon Communications Inc.

Vehicle Tracking System Market Report Segmentation:

By Component:

- Hardware

- OBD Device/Tracker

- Standalone Tracker

- Software

- Vehicle Diagnostics

- Performance Measurement

- Fleet Analytics and Reporting

- Others

The vehicle tracking system market is dominated by its software component, which provides crucial functionalities like vehicle diagnostics, performance measurement, fleet analytics, and reporting to optimize fleet operations.

By Type:

- Active

- Passive

Active vehicle tracking systems, which constitute the largest market share, provide real-time location data through continuous communication, making them essential for efficient fleet management in logistics and transportation.

By Vehicle Type:

- Commercial Vehicles

- Passenger Vehicles

Passenger vehicles constitute the largest segment of the vehicle tracking system market due to the increasing demand for connected cars, rising concerns about theft and safety, and their utility for individual owners and fleet operators like rental and ridesharing services.

By Application:

- Mobile Tracking

- Cellular Tracking

- Satellite Tracking

Satellite tracking holds the largest market share in vehicle tracking applications, offering reliable global coverage, especially in remote areas crucial for industries like logistics, mining, and oil & gas, as exemplified by Monimoto's recent satellite-based anti-theft system launch.

By Industry Vertical:

- Transportation and Logistics

- Construction and Manufacturing

- Aviation

- Retail

- Government

- Others

The market is segmented by industry vertical into transportation and logistics, construction and manufacturing, aviation, retail, government, and others, with transportation and logistics being the largest segment.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America is the largest regional market for vehicle tracking systems due to high demand for fleet management, advanced technological infrastructure, stringent safety regulations in the U.S., the need for real-time monitoring across key sectors, and impactful partnerships like Geotab and Rivian.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145